“If there are no more buses, the fire station is not crewed, the shelves in the supermarket are no longer restocked, and the day care center closes due to a lack of staff,” if this is the case due to unaffordable rents, then “a city as a whole falls into crisis.”

In the February edition of the street magazine BISS in Munich, academic researcher Simone Egger describes how the city could be at the precipice if its housing situation continues in the same way. On the magazine’s cover, the title of her article reads Who owns the city?

“The manager then sits in an office that nobody cleans, and the architect, who has to look after his children, can no longer pursue his professional duties.” Underneath every shiny city, there’s a story of many lively voices concentrated in one small space. Egger compels us to hold our governments and ourselves accountable for the right to belong in the city for everyone. “A balanced society is necessary to keep Munich socially and politically healthy,” she writes.

To the very same question Who owns the city? researcher and economic equality campaigner, Christoph Trautvetter, is finding answers in a rather practical way. He wants to get a grip on the facts about ownership structure in cities. The new circumstances could lay the groundwork for a genuine public debate on affordable housing and prompt the necessary policy changes.

It might be hard for some people to believe, but not all tenants know who is cashing in the rent every month. Often, anonymous companies from Luxembourg and Delaware also appear as property owners. Trautvetter began to navigate this reality when someone was evicted close to his house, causing a stir, and a journalist asked him for support in tracing the owner, who was using a similar tax structure.

What started as a small research project has evolved into a comprehensive study of ownership structures, first in Berlin and then in other cities, supported by the Rosa Luxemburg Foundation. This wasn’t unusual terrain for Trautvetter. He is a political scientist and public policy expert, and a member of the Tax Justice Network, where he focuses particularly on topics such as money laundering, analyzing ownership structures, illicit financial flows, and tax issues.

Amid rent increases of more than 150 percent over the last decade, tenants in German cities are starting to ask questions about the owners and their business practices. The problem is particularly visible in Berlin, where the pressure of displacement has skyrocketed. While international real estate funds and private investors buy freely in the city, Berliners want answers.

Unfortunately, responses are relatively poor. “We had this discussion with the Senate of Berlin (the executive body governing the city of Berlin),” Trautvetter tells me. “We did an official request about ownership structures, and they came back with a response that wasn’t helpful at all because it just contained statistics about the company types available in each district, but neither the names nor the owners behind them. Until today, the senate doesn’t even know who owns more than 3.000 apartments in the city, even though the majority of Berliners have voted in favor of a referendum to expropriate those owners.”

The lack of meaningful data

Every European city has a Land Registry – even though registration is not compulsory everywhere. While most European cities make their land registers publicly available, others make accessing the data difficult. In Germany, land registers are public but accessible only on a case-by-case basis and with a “legitimate” interest rather than to analyze ownership structure in cities.

To circumvent this, Trautvetter, along with the nonprofit investigative journalism organization Correctiv and several local media outlets in cities across Germany, launched a campaign in 2018 to gather data from residents through an online survey. In addition, he utilized information from market reports and transaction reports, such as Thomas Daily, Immobilien Zeitung, and ImmoScout. Once you have a list of company names, you can obtain further information through their financial reports and company registers to identify the ultimate owner. But it gets trickier to trace information about private owners.

By not disclosing any information about private investors, we obscured the opportunity to see how undistributed wealth is distributed in this country.

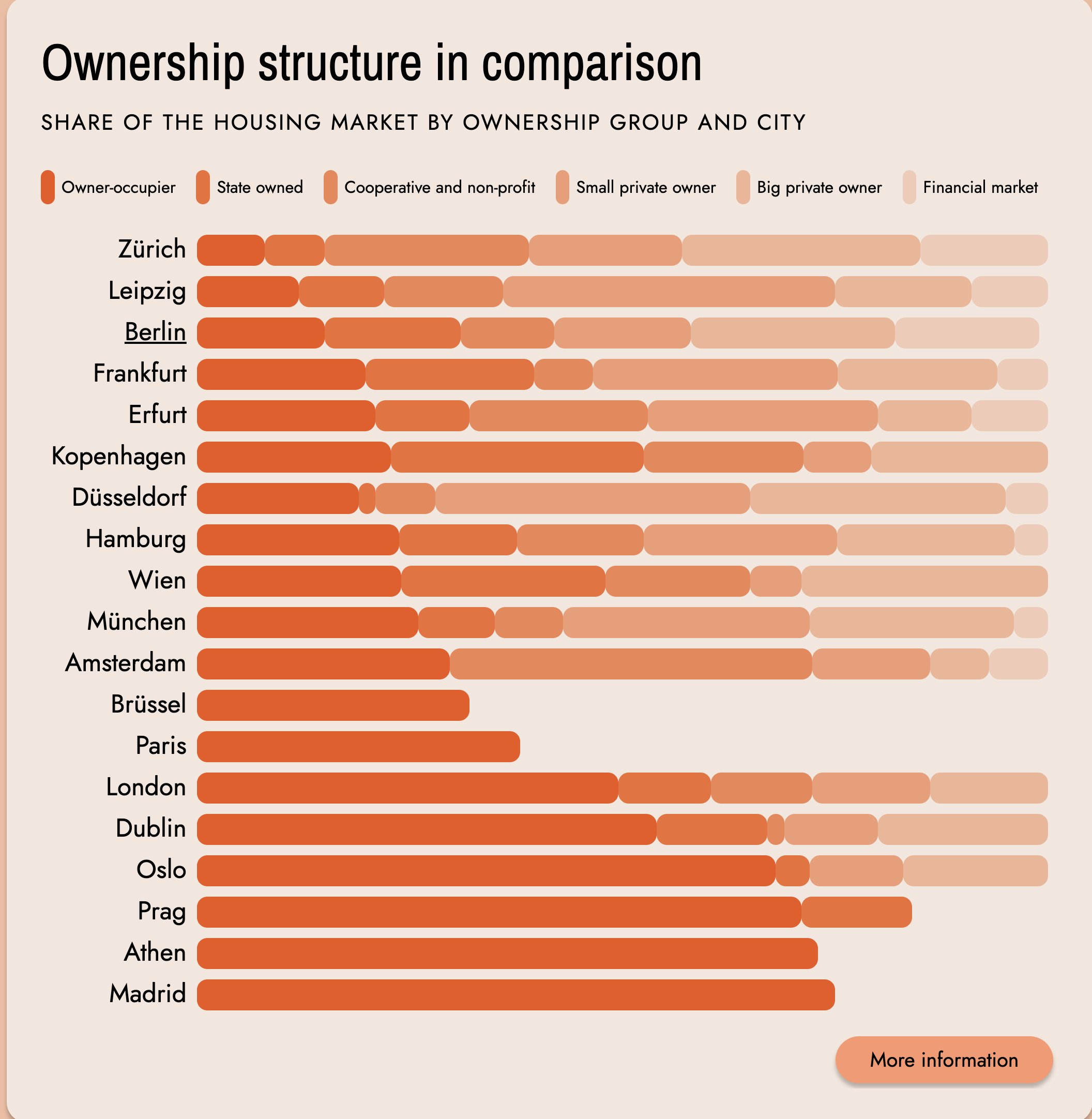

Overall, the study distinguishes five types of owners: self-users, public owners, housing cooperatives and nonprofits, the financial market (Including Private Equity firms, asset managers, and institutional investors), small private investors, and large private investors. It is within the last two groups where the ins and outs of who can afford housing come to the surface.

The official statistics don’t differentiate between small and big private investors. Still, the Real Estate lobby wants us to believe that private owners are mainly small in size, owning one or two apartments. “But statistics show that this is wrong. Yet, 93% of Germans don’t own any rental property, and about half of the privately owned rental housing belongs to a few thousand people who own whole multi-tenant houses with dozens, hundreds, or even thousands of apartments. Among them are many of Germany’s billionaires,” explains Trautvetter. In 1958, a law was passed that allowed individuals to divide a house into apartments and rent them out legally. Many owners benefited from this law, he says.

The opaque real estate market in Munich

In Munich, a significant number of properties, approximately an astonishing 50% of the total stock in the city, belong precisely to private investors. Yet, according to research by Correctiv, the city of Munich does not have an overview of who those owners are. The city administration can only provide approximate information about the large private owners and has listed only a handful of companies.

“We found the response from the city of Munich to be remarkable,” writes Correctiv on its website. In November 2019, the Greens on the Munich City Council sent a written request to the City Planning Officer Elisabeth Merk. They wanted ordinary information about the ownership structure, like other cities do. In other words, how many residential units in Munich belong to funds and institutional investors, as well as how many are owned by pension funds, insurance companies, or private owners — a total of 15 questions. The answer to most of the questions was: “The city of Munich does not have any further information on this”.

The city of Munich was only able to calculate its own stock (a good 70,000 apartments). She named the number of flats owned by cooperatives (40,000), Catholic churches (6,000), and private owners (200,000).

In 2021, the German newspaper Die Welt officially requested real estate ownership data from all federal states. Some states provided data, while others denied it on the grounds of legitimate interest or alluded to data privacy laws. But that is a peculiar answer, says Trautvetter, firstly, because the request was limited to institutional investors, who don’t have the same right to privacy as individuals.

And secondly, because the same data privacy laws don’t prevent cities in other European countries from making the information on ownership structure public. France even provided a free download of the entire register last year.

Based on data provided by some states and municipalities, a study by the Ludwig-Maximilians-University in Munich and Trautvetter shows how much anonymity still remains after using all publicly available information to decipher company ownership chains.

Inherited wealth and home ownership

The website “Who Owns the City?” that Trautvetter has put together offers revealing information. With more than 90% of apartments rented, Zurich is Europe’s capital of tenants, followed closely by Leipzig and Berlin. Over the last few years, the by far largest share of European investments from professional, financial market-based investors has gone to Germany, and in particular to Berlin.

Correctiv has revealed an interesting trend. “In Munich, houses owned by communities of heirs often fall into the hands of institutional investors or funds because the heirs cannot afford the inheritance tax. The ownership structure is gradually changing.”

We are calling on the various German states to either amend the law or provide the necessary data.

Often, Trautvetter was told that the German business model didn’t grow through transparency, as in other countries, and therefore, there is no culture for such a thing. But he continues that, “by not exposing any kind of information on private investors, we blurred the chance to see how undistributed wealth is in this country. The lack of transparency protects power structures that need to be understood.”

“In our study, we saw that the main driving factor for housing ownership is mainly investment coming from wealthy families. Wealth is transmitted and accumulated across generations, and as a matter of course, it determines the structure of housing ownership in cities. Without inherited wealth, prospective first-time buyers will face difficulties accessing affordable housing. These circumstances differ significantly from city to city, depending on the degree of unjust ownership.

Leipzig, a city in the former Communist East Germany, is a good example. Wealth accumulation was non-existent, and as the city opened to the free market, investors seized most of the properties before locals could afford to buy one of their own.

Last week, an op-ed article in the Financial Times illustrated “How London’s property market became an inheritocracy,” where residents are forced to abandon plans of home ownership. Even for a 28-year-old vice-principal at an east London school, who grew up in London and went to LSE, home ownership is more like a “dream”. A reality that Trautvetter says has begun to affect not only blue-collar employees but also German graduates. This Londoner and his partner “are now thinking of moving to Germany in pursuit of a better foundation from which to build a life together.” This might not be a good solution.

Over the years, Trautvetter’s dedicated work with Who Owns the City? has compelled trust among city governments. It demonstrates why it is essential to be well-informed about ownership structures in cities to make informed decisions when it comes to policy.

“We are calling on the different German states to either change the law or provide the data,” says Trautvetter. He cites significant progress with the decision by the Ministry of Finance to collect all 350 registers available in Germany and send them to a central location, where approximately 100 people will be hired to connect the data and analyze it. This has been particularly accelerated to enforce the application of Russian sanctions law to German properties.

Besides, proper data on ownership structures in cities could dismantle some myths, says Trautvetter, like “if you work hard, you can afford to buy a home,” or “we can’t regulate the rental market because the pension of your neighbor (related to the performance of investment funds) depends on those rents.” If politicians have a better understanding of the market, citizens can obtain information more easily, and journalists can conduct research with fewer obstacles, the chances of correcting injustices are increased.